From confidence in financial acumen, time constraints and lifestyle goals, high-net-worth primary breadwinners – both women and men – have a lot in common.

Learn what these investors value.

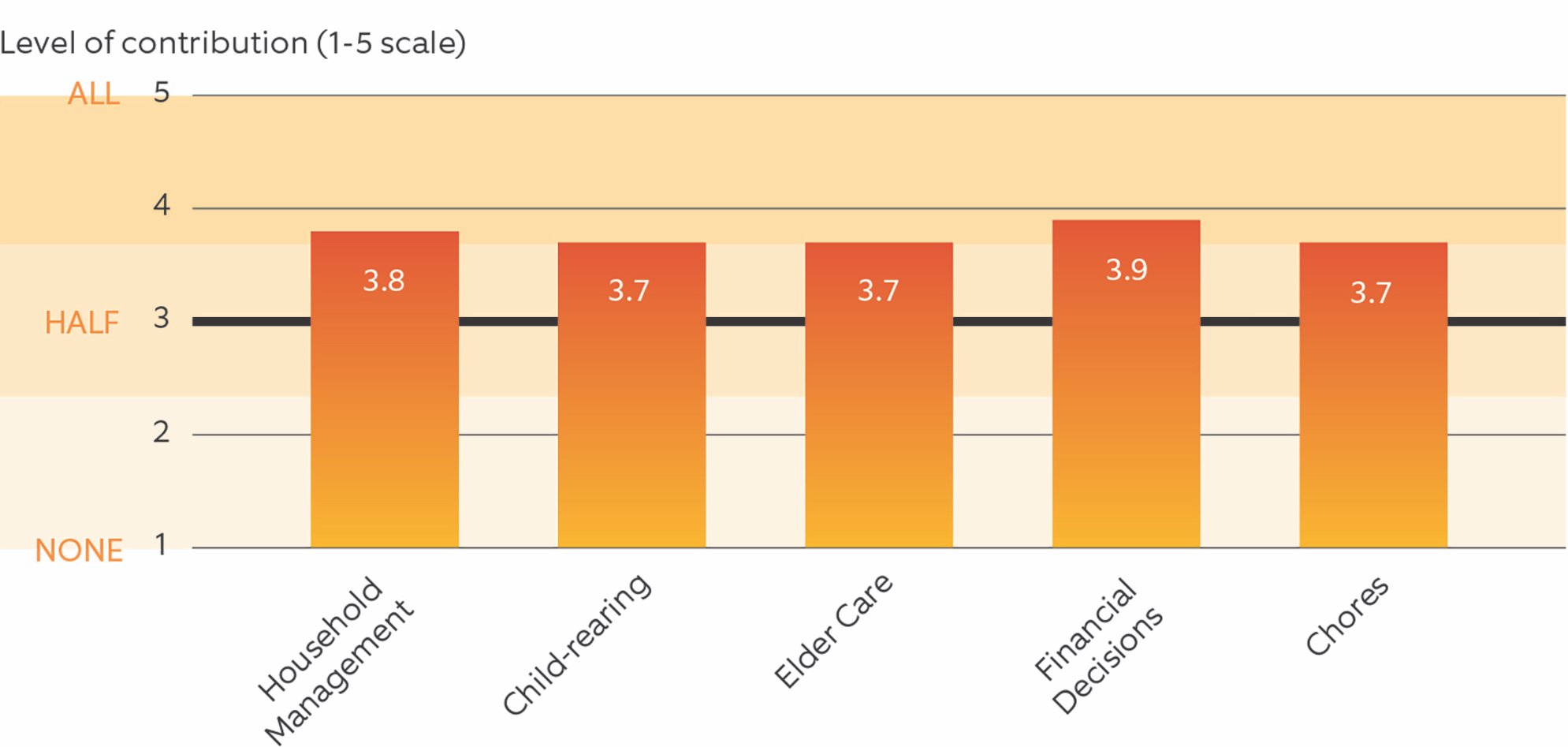

Our research indicated that while there were some variances among executives by gender and age, for the most part, this cohort is quite similar. They are very much engaged in the wealth management process and share similar views on a variety of lifestyle attributes.

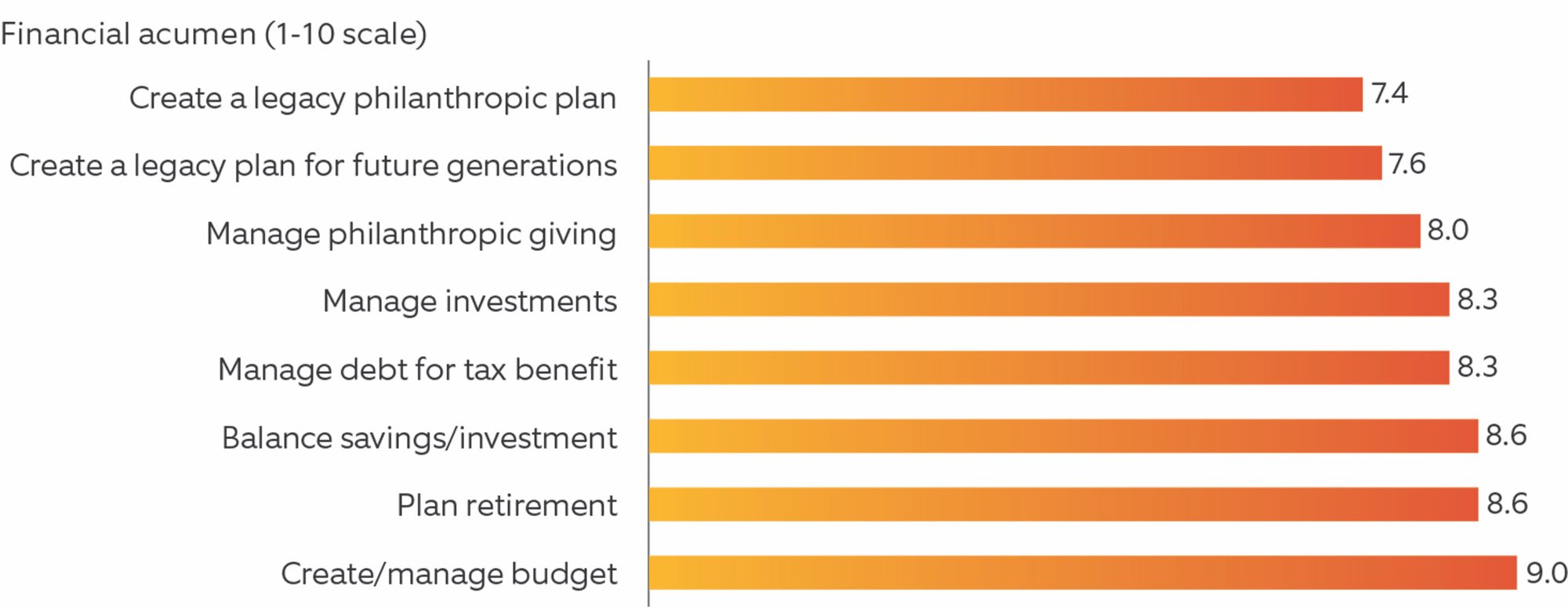

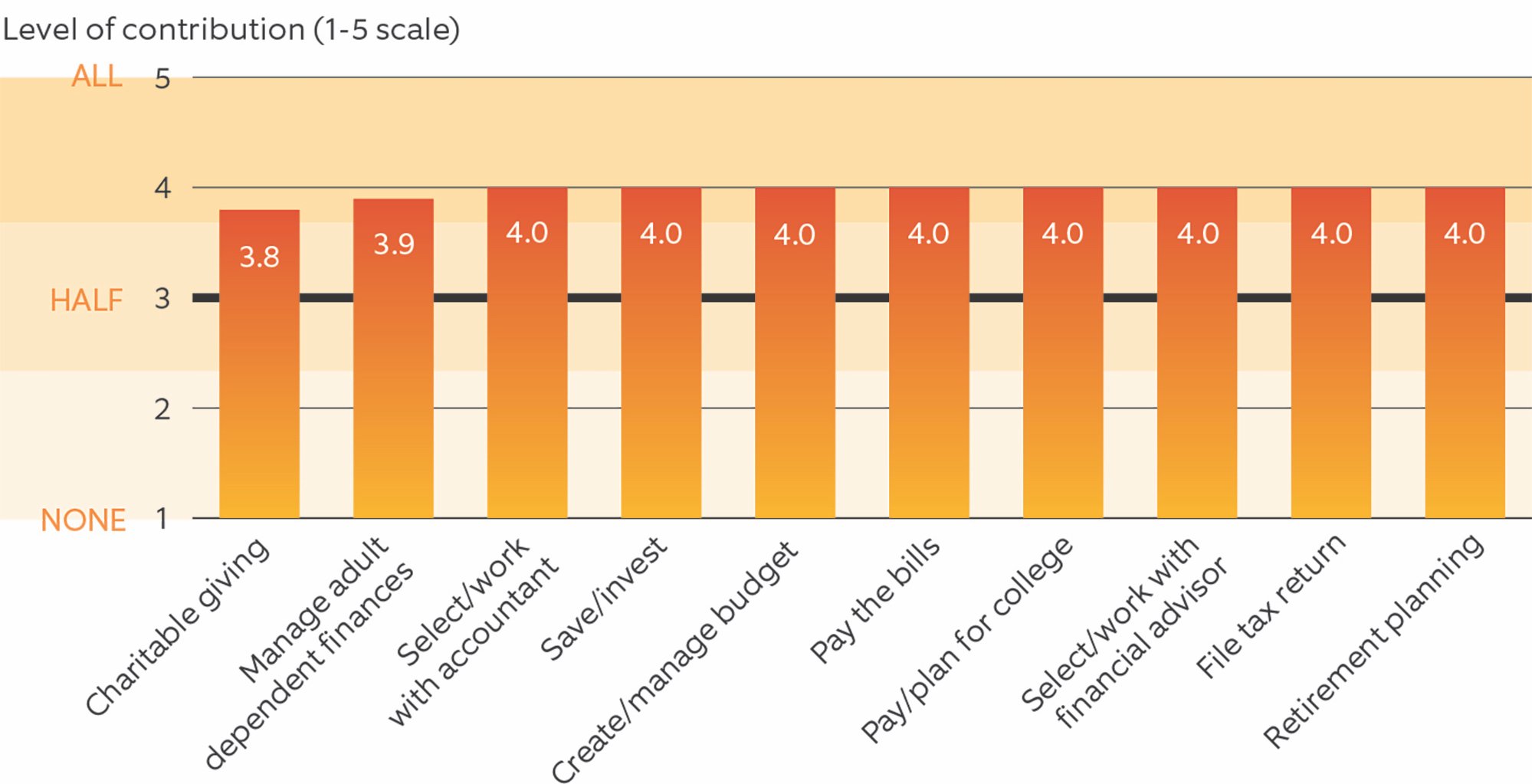

Respondents were confident in their financial and investment acumen as measured by a variety of inputs.

When asked to rank themselves on a scale of 1-10 in financial confidence, wealth creators rated themselves above average on eight financial activities.

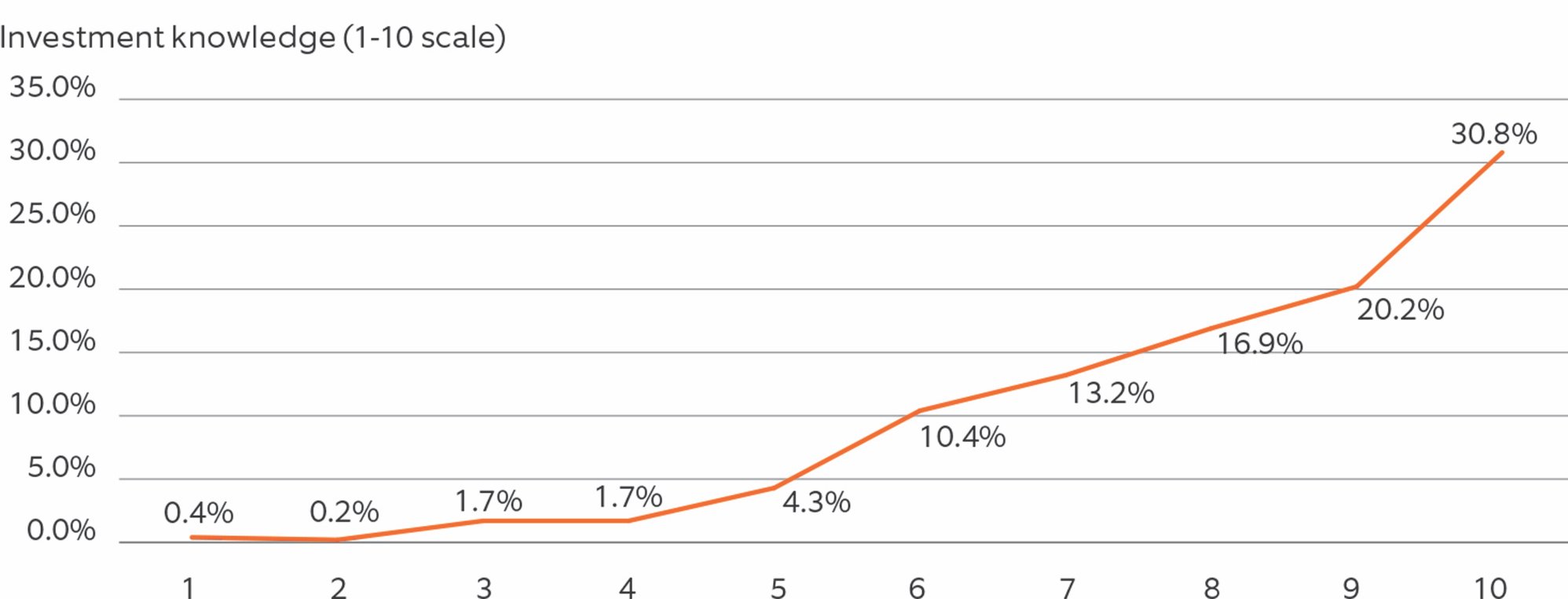

More than half of respondents rated themselves a nine or 10 as it related to their investment knowledge. As their level of investable assets increased, the more likely they were to express higher levels of investment knowledge.

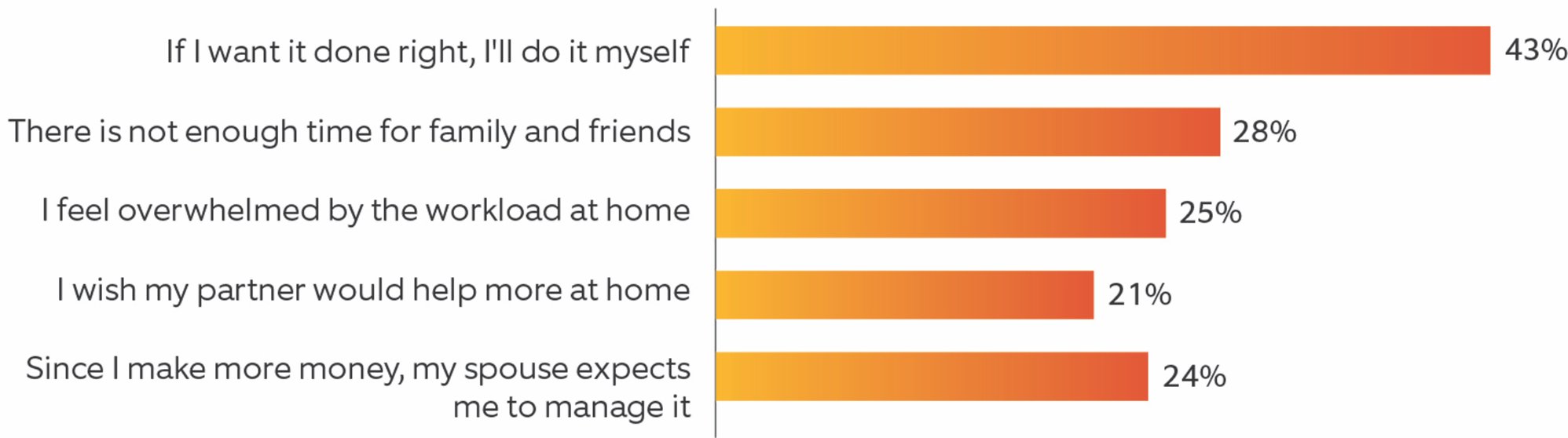

Lifestyle was an important consideration in the wealth management experience of HNW primary breadwinners.

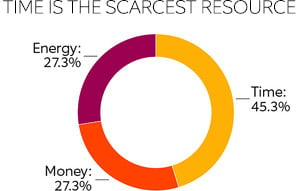

Time was what HNW primary breadwinners of both genders considered their scarcest resource, followed equally by energy and money.

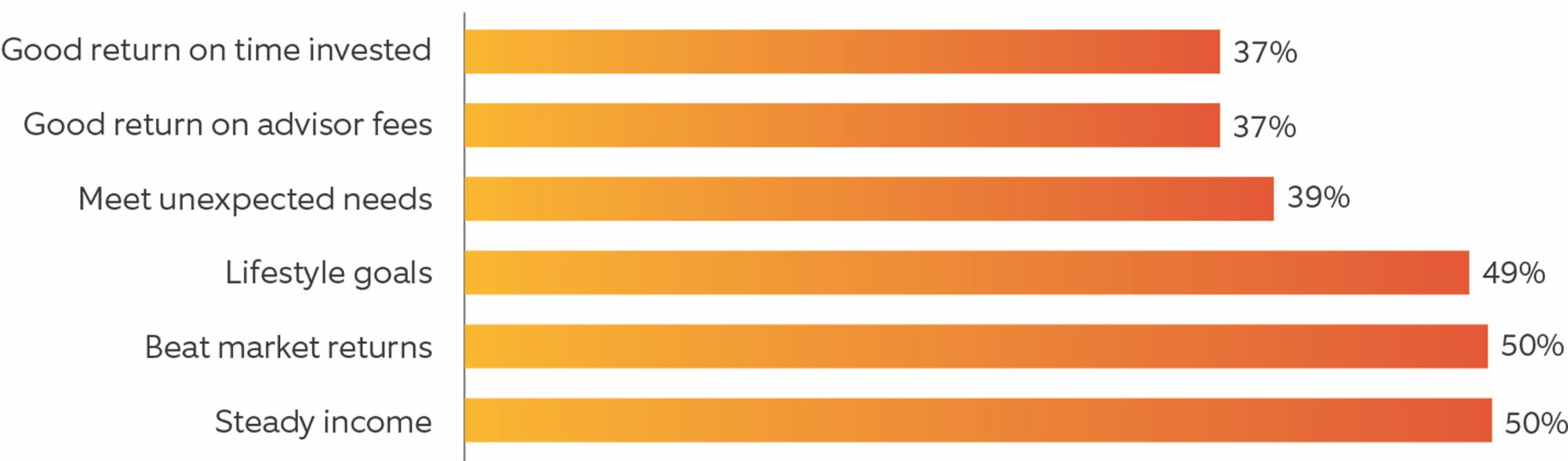

When considering investment performance, achieving lifestyle goals ranked nearly as high as beating market returns and generating steady income as an indicator of strong performance. Among their essential financial objectives, 21% of wealth creators said they want to minimize work and maximize their purpose.

HOW EXECUTIVES VIEW PERFORMANCE

The survey asked: “When you think about your investment portfolio, which of the following would indicate strong performance?

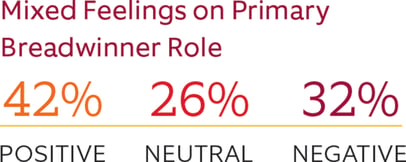

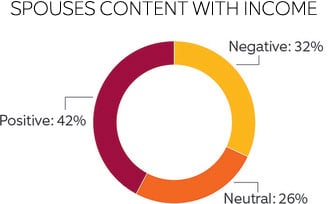

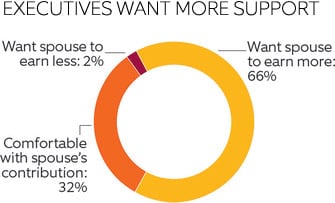

Feelings about household income

DIY

43% of HNW primary breadwinners feel if they want something done right, they have to do it themselves.

FlexShares offers an array of ETFs, designed for all types of investors. Visit our website to learn more.

Read more of our unique insights on other investment and advisor topics in our Insights section.

IMPORTANT INFORMATION

Before investing, carefully consider the FlexShares investment objectives, risks, charges

Foreside Fund Services, LLC, distributor.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

MANAGED BY NORTHERN TRUST