Our research of both men and women wealth creators enabled us to test the viability of mainstream gender assumptions around wealth management. While executives of both genders have a lot in common, there are some stark differences that advisors should understand to enable better conversations and relationships.

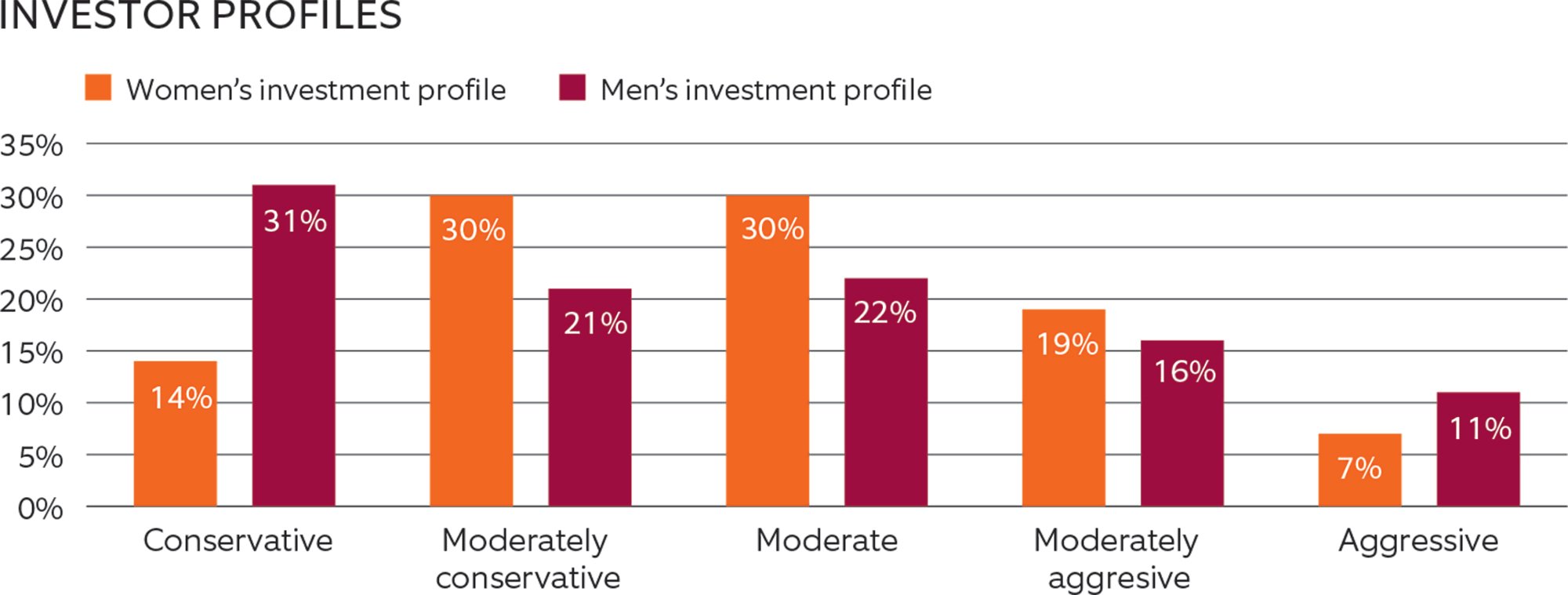

Women in the survey broke some common stereotypes often found in the wealth management industry. Executive women were only half as likely (14% vs. 31%) as men to identify as being conservative investors. They were on par (26% vs. 27%) with their male counterparts as identifying as either moderately aggressive or aggressive investors.

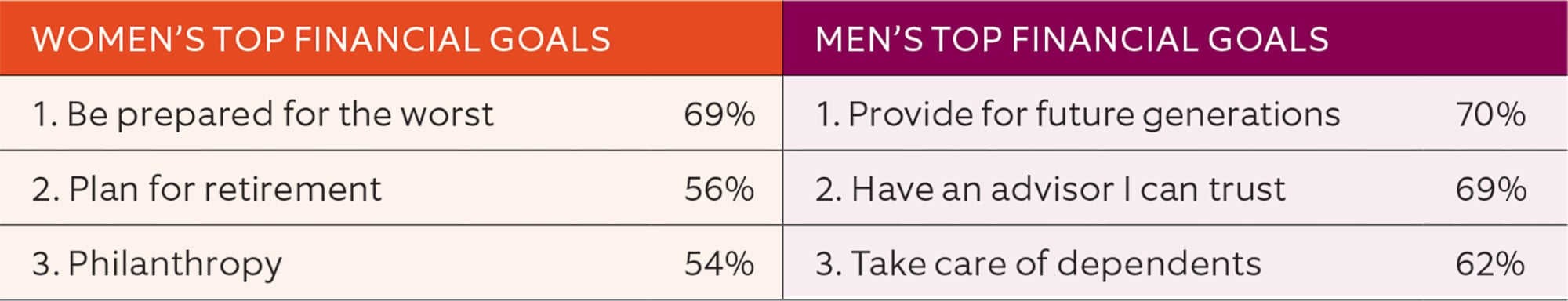

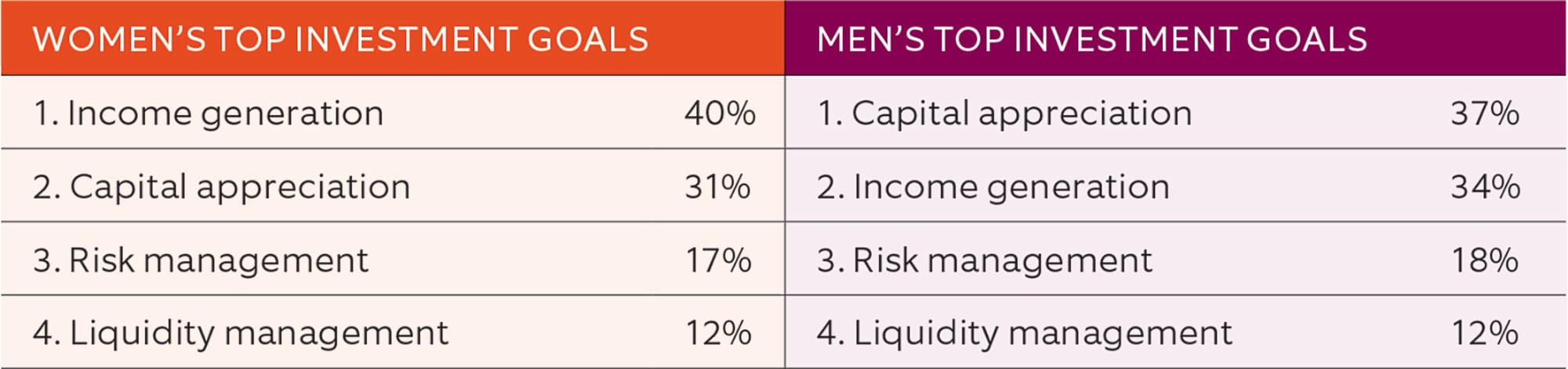

We often hear that women invest primarily to take care of their families. Our survey revealed that providing for dependents and future generations were at the bottom of the list of current priorities for executive women but on the top of the list for executive men.

Stated investment goals revealed that women were more concerned with generating income while men were most concerned with capital appreciation.

Since so much of the investor research by gender is typically done without much segmentation – all women or all wealthy women – we found that common gender themes did not always hold true with this cohort of HNW primary breadwinner women.

A common theme in the industry is that women are not loyal to their advisors, especially after a divorce or a death of their spouse. While we didn’t frame our survey question in that manner, there were significantly fewer female respondents (20%) than men (39%) that considered leaving their advisor in the previous 12 months. Executive women were also more likely to describe the experience with their advisor as being personal (88%) compared to executive males (75%).

Executive women were less likely to care about the gender of their advisor. Just 12% of women indicated a preference in gender versus 25% of executive men. Our female respondents also found it less important than men to work with an advisor that focuses on gender specific financial issues.

We often hear that women and millennials are the groups that are most interested in sustainable investing. Women in our survey were definitely interested in this type of investing, but less so than the men in our survey.

Men were more likely (59%) than women (47%) to

remember a great client experience provided

by their advisor.

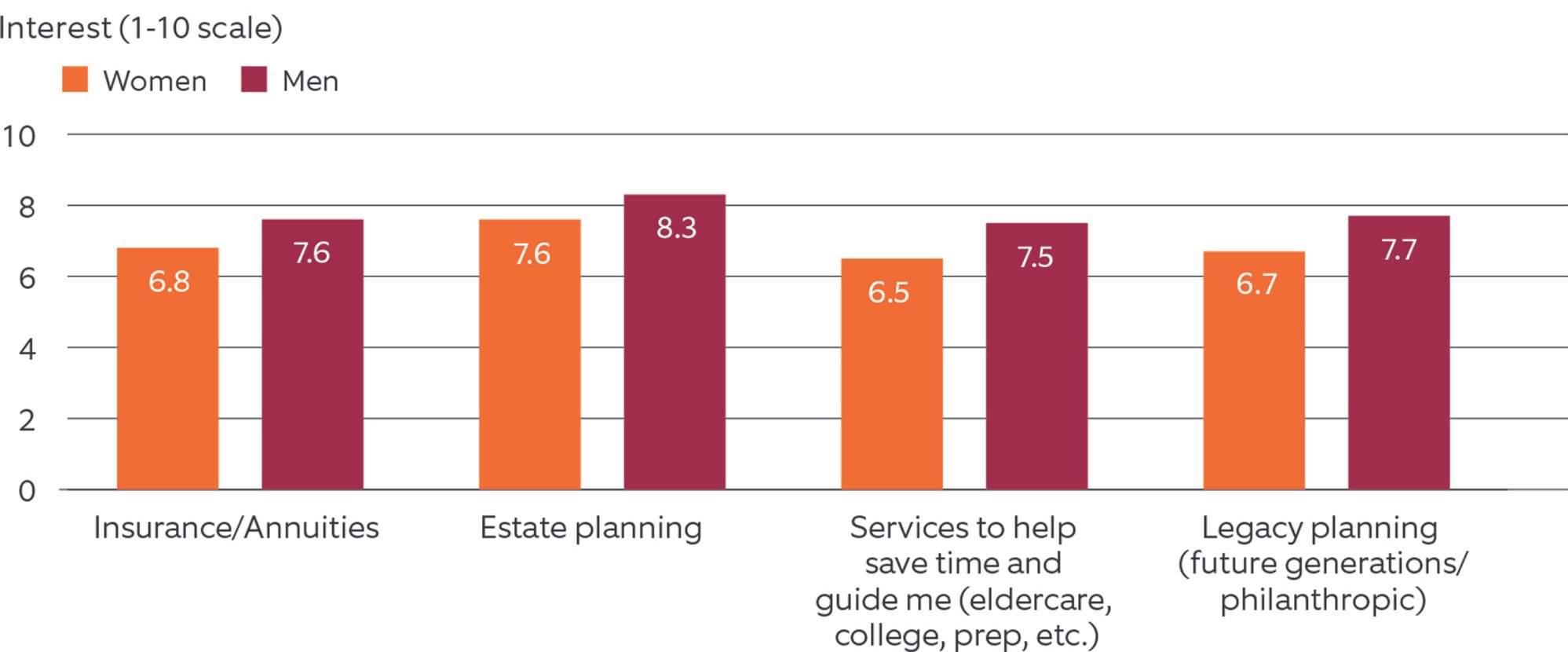

Women in our survey, while interested in specialized services, found them to be less important than their male counterparts.

INTEREST IN SPECIALIZED SERVICES

Respondents rated the importance of specialized services.

FlexShares offers an array of ETFs, designed for all types of investors. Visit our website to learn more.

Read more of our unique insights on other investment and advisor topics in our Insights section.

IMPORTANT INFORMATION

Before investing, carefully consider the FlexShares investment objectives, risks, charges

Foreside Fund Services, LLC, distributor.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth. As with any type of portfolio structuring, attempting to reduce risk and increase return could, at certain times, unintentionally reduce returns.

MANAGED BY NORTHERN TRUST